Green Acres: The Developing Plan for the Elberta Waterfront and Northern Dunes

More details on GTRLC's proposed Elberta Waterfront Community Conservation Project, and how the issue of lost tax revenue will be solved.

This is a developing story (!). Check back for updates. And send questions!

* Visit the Land Conservancy’s Elberta Project Page, with Donation Button *

Today, Monday, August 26, the Grand Traverse Regional Land Conservancy announced that its board has unanimously approved the Elberta Waterfront Community Conservation Project. Which I shall be referring to unofficially as EWNoD.

In an email to me, Jennifer Jay, GTRLC’s communications director, said: “The final hurdle is raising the purchase price by December 15!” The conservancy intends to raise a total of $27.5 million, and Jay said they have so far received “gifts or pledges totaling $14,900,000.”

You may notice that goal number is significantly higher than the purchase price of $19.5 million announced back on July 3. That’s because the plan builds in funds for an endowment. But the $19.5 million figure is what’s needed by December 15.

To recap, if fully funded, the project would create a 10-acre dune forest sanctuary (see dark green area on map above), 16 acres of new public parkland (striped lighter green area), and nine purple acres (some of which is already developed-ish) for the Village to do community development (housing, a roller rink, an outpost of Oryana, a cryogenic human storage facility, a woodworking school … whatever we can dream up).

When the project was first proposed, back in July, a few community members in comments on the Alert and at meetings brought up the important topic of loss of tax revenue. At the August 15, 2024, Village Council meeting, Commissioner Gary Sauer raised the issue as well, with some rough figures.

Loss of Tax Revenue in the Short-Term?

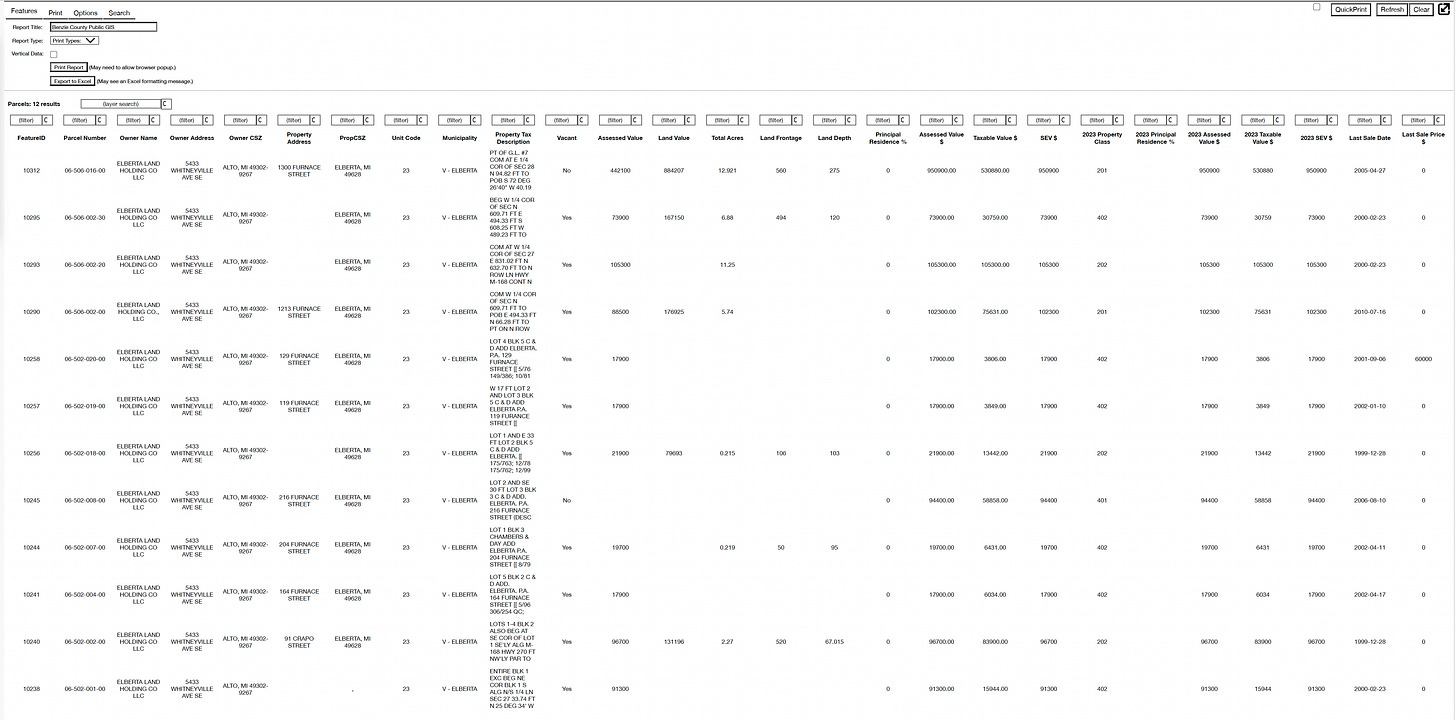

It’s true: The current owner of the 12 properties that make up the project area, Elberta Land Holding Company (ELHC), is a non-homesteaded private landowner and is billed a total of about $51,512.27 in taxes on these properties each year, of which $13,232.01 goes to the Village. I say “about,” because these figures are based on the 2023 assessment. (For more on how I calculated, see section way below; I confirmed the numbers with Kelly Long, the county treasurer.)

If the GTRLC acquires these 35 mostly undeveloped acres, which have been owned by ELHC since about 1999, those properties come off the tax rolls, because conservancies under current Michigan law do not pay property tax.

The county would theoretically lose money, and $13K is not an insignificant sum of money for the Village to lose out of our budget of about $1.1 million. For example, $13K could cover the $18/hour wage of part-time help in the office, which we desperately need more of. And it would be nice to offer a qualified person more than $18 and a bigger incentive to stay and grow with us.

Furthermore, the 16 acres of additional parkland in the plan will definitely require additional DPW hours and office work. In our Personnel & Policy committee conversations, we’ve already started discussing personnel needs in case this deal goes through, and it might be at least one extra full-time DPW employee. I think this is an underestimate, given how busy Justin Towle and Chris Cervantes already are.

We are also overdue to hire some kind of code enforcement officer. The need for a dedicated person to enforce our ordinances is already manifest, and I imagine that will become more urgent amid further wide open public spaces with sensitive natural areas in the mix, not to mention more housing or commerce in the purple part.

So: additional human and financial costs for upkeep and whatever new challenges new parkland and development brings, plus a loss of revenue. Sounds a bit scary.

But, at least in terms of the revenue question, according to the GTRLC’s plan as presented today …

Not Only No Loss, but Potential Future Significant Gain in Tax Revenue

According to Jennifer Jay: “We’ve budgeted to pay property taxes for the period of time that we will own the 26 acres [park plus preserve], and that tax amount will be higher than it is currently (it will be uncapped).”

She continued: “If redevelopment begins on the remaining 9 acres within the next 3-4 years, there is probably no tax hit to the county or the Village, and it is more likely that the increased value will result in a higher tax base.”

Remember that the only developed parts of those nine acres now are a couple of vacant, blighted houses and a triangular parking lot. The Michigan State Land Bank Authority will be helping us manage development by reviewing the credentials of developers and advising our planning commission. The SLBA are revenue focused, because successful redevelopment is how their agency is funded (they take a cut). Just about anything new that occurs in Area Purple will raise that property’s value from a tax standpoint, but if maximizing tax revenue (or how the Marina District will be transformed) is important to you, now is the time to start coming to Council and Planning Commission meetings. We have a lot to do to get our zoning ordinance ready for new development that enhances the whole Village.

As for the expenses associated with added parkland, GTRLC promises some relief for that as well, Jay said. “We are striving to raise endowment money so that the Village can take excellent care of all their parks and natural areas in perpetuity.” If you would like to see a field of solar panels, some giant sculptures, a skatepark, community garden, or butterfly sanctuary in EWNoD, now is a great time to start coming to Parks and Recreation meetings. As GTRLC’s director of land protection, Chris Sullivan, an avid fisherman himself, said back in July, fishing access can also be an emphasis in the park. Do we need a fish cleaning station? Other amenities? And what about the Betsie Valley Trail extension? This is in the plan! What do we need to do to create a park that meets the needs of both fishing enthusiasts and trail users — a noise buffer between the trail and the shore in key areas? I’m just spitballing. Your expertise is needed.

The possibilities at this point are pretty open, and the community members who show up will be heard. The Alert’s mission is to amplify Elberta voices, so talk (or write) to me all about it. Stay tuned for a survey!

And if you can donate to the cause and help meet the December 15 fundraising deadline, or convince other people you know to do so, it will help ensure the Village enters this new era on the best possible footing to protect our beautiful land for everyone to enjoy.

Here’s a fun rainy-day or deep-winter activity: Look up how much your neighbor pays in property taxes! You can do this with the County Equalization department’s Parcel Search feature on its website. It’s a little wonky and slow to load, so I’ve done it for you as regards the 12 ELHC properties (2023 values). Here’s what I looked at:

And here’s the calculation, based on 2023 assessment numbers:

The Property Tax Calculator — Enter the Taxable Value and Look at the Bottom of Column D