Alert Explainer: The Headlee Reset

It’s not an EDM artist, it's a tax measure. Plus: a handy calculator to figure out what you'd owe if it passes.

Colin Merry of the Benzie County Record-Patriot has been doing a lot of online and print reporting about the Headlee Reset, a ballot measure county officials are seriously discussing for the November 2024 election. If the measure gets on the ballot, and passes, the county operating millage will go back to what it was in 1982: 5.29 mills. It is currently, because of knock-on effects of the 1978 Headlee Amendment, at 3.3378 mills.

At the November 16 council meeting, our county commissioner, Gary Sauer, said the county would pursue putting the Headlee Reset on the ballot if all 12 townships agree. As of that meeting, three townships were against, including Gilmore, he said.

In a January 10 Record-Patriot story, county administrator Katie Zeits was quoted saying townships have until February to decide, and though she’d like to get all the townships on board, they will move forward with putting the reset on the ballot even if only half buy in.

If you just want to know right now what the reset will do to your property taxes, skip on down to the calculator below. Otherwise, read on for some fun history.

The Headlee Amendment and Rollback: What Happened?

If you’re of a certain age, you’ve lived through a couple of recessions and some dramatic fluctuations in the economy and property values since 1982. It’s possible that even the visionary anti-tax warrior Richard Harold Headlee himself may not have foreseen or considered some of the things you’ve been through.

Born in Iowa, this Taurus was George Romney’s campaign manager in 1966 and became a member (and later a two-time bishop) of the Church of Latter Day Saints. He himself ran for governor against Jim Blanchard in 1982. (I got this information from Wikipedia. Please donate to them.) Though he lost that bid for the executive seat, Headlee has arguably had a longer-lasting impact than most governors because of the tax law that bears his name.

The Headlee Amendment to the Michigan Constitution was adopted in 1978 and did several things, not all of which seem bad. It banned unfunded mandates (when the state requires localities to do something but doesn’t give them money to do it) and requires about half (48.97%) of state taxes to be distributed to local governments—this is the famous state revenue sharing, from which Elberta gets about $35,000 a year, per page 19 of the CVTRS Notice and this state revenue sharing web page [1/2824]. The (now) state funded mandates are not supposed to be included in that 48.97%, but must be funded over and above normal revenue sharing.

Further, the Headlee Amendment put a cap on state revenue at 9.5% of the total personal income of the state. It means that even if the fortunes of Michigan’s residents rise, the state can only take a 9.5% slice of their pie. That sounds like a tight belt for the state government, doesn’t it? Well, you don’t get called a “Giant in Michigan History” by the Mackinac Center for Public Policy by *loosening* the state’s fiscal waistband.

As it turned out, though, according to Bridge Michigan, we have barely ever gotten close to that 9.5% spending limit: The state’s revenue managed to squeak up to 9.5% of total personal income only in 1994, 1998, and 1999. For whatever reason (it’s probably complicated), it seems that none of our state legislative bodies since Headlee have really tried to push that spending envelope, even up to the point Headlee specified.

Were Headlee, a conservative anti-tax insurance man, alive today, as Bridge asks, would he look at the sorry state of the state and be a bit horrified by the results of his signature legislation? He couldn’t have predicted the hit that the Michigan economy was going to take starting in, oh, 1978, and that the decline would only hasten—maybe in part because of lack of money for infrastructure, health care, and schools?—as jobs and brains drained away, the major car companies struggled, and we got 9/11d and pandemicked.

Anyway, after his successful legislation passed, Headlee beavered on, gnawing away at taxation and government spending as a member of Taxpapers United Federation. The 1992 Headlee Initiative limited the growth of state spending to the rate of inflation. In that year Headlee and his allies also succeeded in setting term limits for all state level elected officials, executive and legislative. Also someone died on a motorcycle in Texas and Headlee got his heart.

OK, but we were talking about your property taxes. How did the county operating millage go from 5.29 mills in 1982 to the 3.3 and change it is today?

Before the Headlee Amendment, property taxes were linked more directly to property values. When your property value went up, your taxes did to roughly the same extent. Same for when they went down. The factory moves out of town? Well, at least your property taxes went down. Your town becomes a tourist haven? Whoops, now your taxes are too high and you have to move. But Headlee tied property taxes to inflation rather than property values, and prohibited local governments from raising property taxes higher than the rate of inflation; indeed, governments have to reduce their millages if property values surge past the inflation rate in a given year. (Because people shouldn’t be punished for being better off! They should be rewarded!) And yet when property values went down, such as they did during the Great Recession of 2008–10 (who all here remembers being underwater then, and not in a fun way?), property taxes went way down with them. This is what’s known as the Headlee Rollback. County revenues went down, and then they stayed down. And there they sit now, even as the pandemic goosed our property values up to hitherto unheard of levels. Your property is worth way more, but your taxes (and county revenue) are still way down, and municipalities are feeling the pinch as they try to continue to provide important services and hire qualified employees.

(You can learn more about this than I did from the good ol’ Michigan Libraries Association.)

Something called the Headlee Override (a bit aggressive sounding, no?) has been attempted by many communities over the years. I remember a campaign by Gilmore Clerk Sharyn Bower and Treasurer Laura Manville in about 2010, to get an Override on the ballot and get the county back to its charter millage. I can’t remember whether it actually got on the ballot at that time, but either way it didn’t succeed.

Now here we are again, and the county’s financial situation is arguably even more dire than it was in 2010. I hope this rebranding, if you want to call it that, to “Reset” (not Override) makes the measure sound like a chill EDM artist everyone wants to vote for. But everyone needs to understand what they’re voting for, or against.

The Headlee Reset would return the county operating millage rate to what it was not so very long ago, a time when the car ferries and railroads were in operation, the schools were full of kids, there were jobs and stores and good lord, police coverage and our own fire department here in Elberta. It’s not going to bring those things back, but it will improve the fiscal health of the county, and pave the way for a more thriving year-round community. Or at the very least, as Colin Merry reported, it would probably mean fewer special millages for services like animal control and the school resource officer, which would be bundled into the county’s general fund.

For some perspective: In 2005, Elberta’s total millage rate was 37.0518, according to the State of Michigan. That rate went down every year after that until 2013, then reached a peak of 39.3068 in 2014, and is now way down again at 36.7822 (see cell C30 below). We are paying less in property taxes than we did nearly 20 years ago, and it really shows.

If you’re a longtime resident, maybe you remember a time when there were more services locally, or the county just seemed to run more efficiently or smoothly. If you do, or if you have another perspective, I’d love to hear it in a comment below.

Use the Calculator

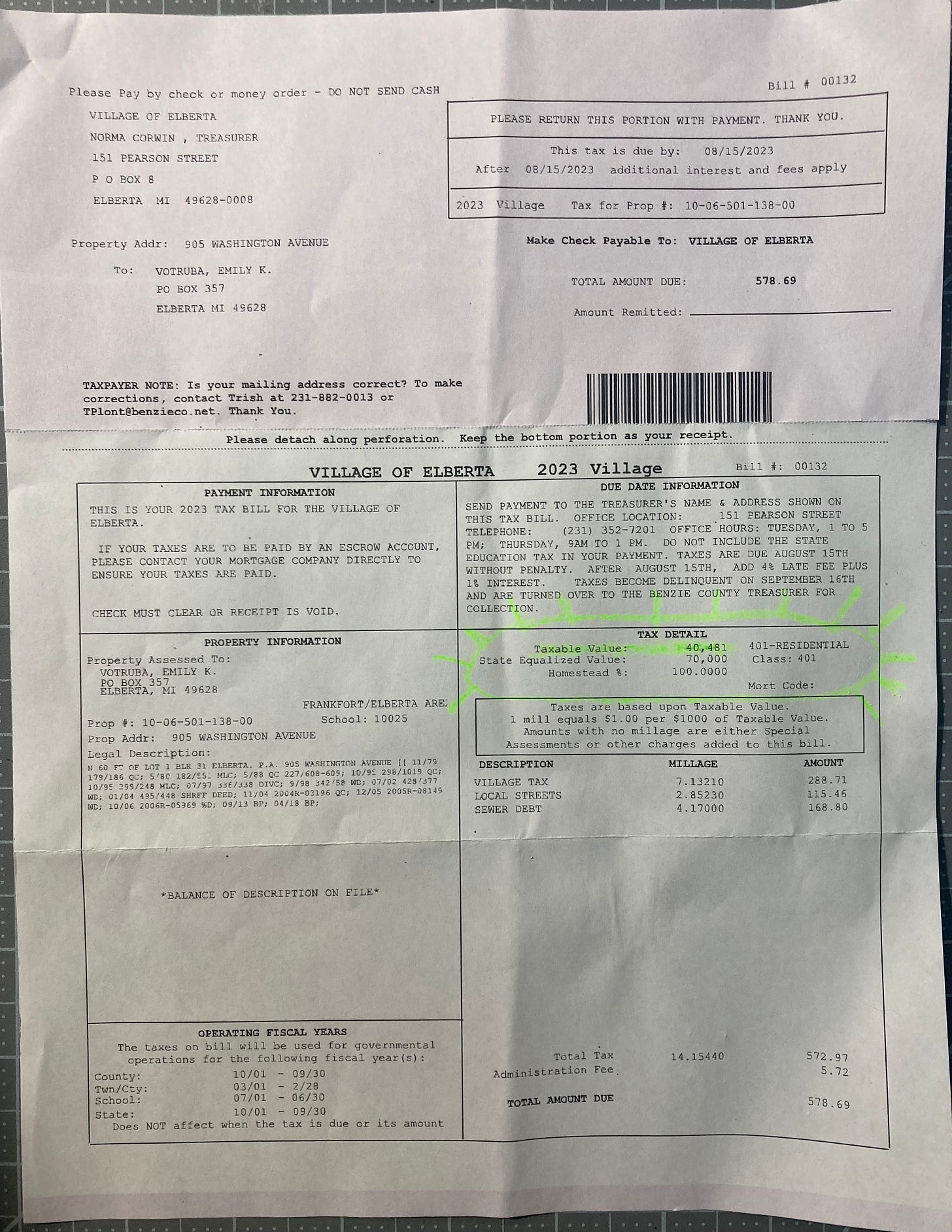

^^ Click on this link to see how much more you would pay. You’ll see a spreadsheet that looks like the image below. You put in your taxable value in the pink cell, and the calculator does the rest. If you’re a Gilmore Township person, your answer is in the green now yellow field at the bottom (with the Village’s taxes minused out).

What’s My Taxable Value?

Find your property tax bill. Your taxable value is located in the spot highlighted in green here:

Ok thank you!

How do we find out our taxable value?